Table of Content

If you are unsure you should get independent advice before you apply for any product or commit to any plan. In most cases, you will be charged interest only on the funds you actually borrow, as opposed to the total credit limit. Once your credit limit is approved — the maximum amount that you’re able to borrow overall — you can start drawing from your line. You can’t usually pay a contractor with a credit card and it can be hard to predict how much a home improvement project will cost down to the last dollar. In order to calculate how much your rate will be, you simply have to add the bank’s prime rate to the increment%. A line of credit can provide you with an ongoing and convenient way to withdraw funds whenever you need to.

Some lines of credit also demand loans that are structured to allow the lender to call the total amount due at any time for immediate repayment. Even if you open your HELOC with a low interest rate, you can still end up with a high interest rate later in the loan term. This makes it hard to predict your monthly payments, which fluctuate with changing rates. The interest rate can change over the life of the loan, though banks must disclose a lifetime cap at signing. The easiest way to find current HELOC rates is to look into specific lenders.

Can I Get A Loan With Bad Credit But Good Income

The most expensive HELOC fee is typically the home appraisal. Other home equity lines of credit fees and costs include title insurance, recording fee, tax certification fee, flood certificate fee and document preparation costs. Personal lines of credit are harder to obtain than are most personal loans and credit cards. If you need an emergency loan, applying for a personal credit line may not be your best choice. The amount you qualify for with a credit score of 550 will depend on the lender.

The downside is that if you don’t repay the loan on time, the interest rate can increase significantly. A home equity line of credit is a type of credit that allows you to borrow money against the value of your home. The interest rate on an HELOC is usually variable, which means that it can change over time. A home equity line of credit is a loan you can use to borrow money against the value of your home.

Mortgage Rates

If the prime rate goes up by 0.25 percentage points in a few months from 6.45%% to 6.70%, your interest rate would then change to 13.70%. You can see how the average interest rates in Canada on secured and unsecured lines of credit have changed since January 2013 in the graph below. Some banks offer investment secured lines of credit, where you secure the loan with your investment assets. Canadian banks that offer investment secured lines of credit include TD and RBC. You have to be approved for a HELOC by a bank or lender just like with your mortgage.

Lenders typically use savings and investment accounts as collateral for high-dollar lines of credit. When you’re ready to apply, you can compare lenders that offer lines of credit to learn more about their specific requirements. A line of credit can give you quick access to money if you have an unexpected expense that is difficult to pay for with a credit card. Interest is usually only charged on the funds you actually withdraw. You won’t need to submit a credit application every time you need to make a withdrawal from your line of credit – once you’re approved, the funds are there for you to use whenever you need them. You can even get some lines of credit that are linked to a debit card, giving you more flexibility.

How Much Loan Can I Get On A 50000 Salary

Then you’ll receive a revolving line of credit available for a set period of time, known as the draw period. The minimum amount you will need to pay each month (does not include any payments for the Fixed-Rate Loan Payment Option). The payment amount includes both principal and interest (minimum of $100). The monthly required payment is based on your outstanding loan balance and current interest rate , and may vary each month.

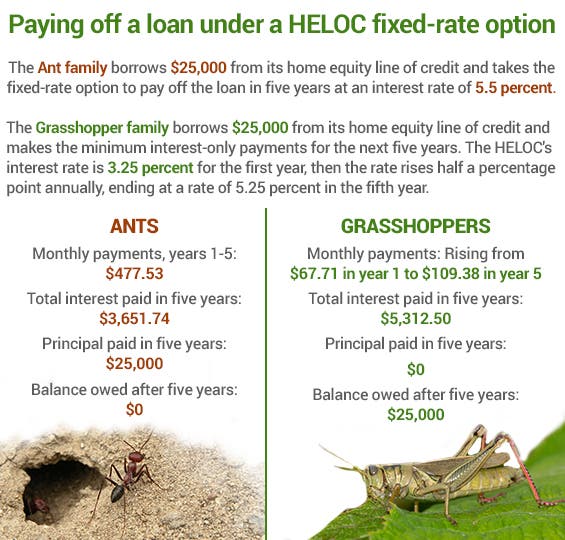

If you take out a HELOC, making interest-only payments can be a risky strategy. You don’t have any way of knowing what rates will be when your draw period ends because a HELOC’s rate is variable. Since rates are already low, they could be much higher later. Plus, the longer you owe principal, the more interest you will have to pay. You stand to save more money if you make principal and interest payments from the beginning. Your interest rate is based on a fixed margin that the lender determines based on your credit worthiness, plus the prime rate , which is variable and can change as often as once a month.

HELOC interest rates

A HELOC is not a good idea if you don't have a steady income or a financial plan to pay off the loan. Since you use your home as collateral, if you fail to make the payments in full and on time, yourisk losing your home. Personal loan - Personal loans may have higher interest rates than home equity loans, but they don't use your home as collateral. Like home equity loans, they have fixed interest rates and disburse money in a lump sum. Cash-out refinance - If you can qualify for a lower interest rate than what you're currently paying on your mortgage, you may want to refinance your mortgage. If you refinance for an amount that's more than your current mortgage balance, you can pocket the difference in cash.

But, remember, if this is a variable interest rate, it can change over time. However, once the draw period is up, you’re no longer allowed to use the line of credit and must start repaying the balance, including principal and interest. Repayment periods often last 20 years, though that can vary by lender. A HELOC allows you to draw money as you need it for a certain period of time—typically the first 10 years—and you only pay interest during this time.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Once your application has been approved and you've signed the loan documents, you can start accessing your line of credit funds.

Fixed monthly payments include principal and interest and remain the same over the Fixed-Rate Loan Option term. Protect yourself from those unforeseen circumstances that may come up. We offer services to help cover your loan payment in the instance that you are disabled from injury, need to take a leave from your job, or are even let go from your employer. Many lenders also offer a fixed-rate option that lets you lock in the interest rate on some or all of the money you borrow from your HELOC.

Of the initial draw depending on where the property is located and your credit profile but no other upfront or ongoing fees. However, you may be responsible for paying county recording fees as well as a subordination fee if you ever ask Figure to change its lien position. You might qualify for a discount if you have a relationship with the bank or set up automatic payments.

In other words, despite having a zero balance, a bank will assume you’ll use all of your credit and test your ability to carry those theoretical interest costs. Lenders source HELOC funds mainly from deposits and other short-term money-market instruments. HELOCs are generally not securitized because they cannot be default insured. Lack of available default insurance increases the yields investors demand, making it too costly to fund most HELOCs via securitization. In early 2020, for example, Tangerine emerged as the most competitive SLOC lender in Canada. Tangerine held on to the title of lowest HELOC rate through the COVID-19 lockdown, with its rate dipping down to just 2.35% (prime – 0.10%).

Not all lenders offer HELOCs, but we can help you find a lender in minutes who does. Lines of credit appear under liabilities on the balance sheet. They are considered current liabilities because they must be paid within the current 12-month operating cycle.

You will want to consider interest rates, repayment terms and the length of the draw period. Interest on a line of credit is usually calculated monthly through the average daily balance method. This method is used to multiply the amount of each purchase made on the line of credit by the number of days remaining in the billing period. The amount is then divided by the total number of days in the billing period to find the average daily balance of each purchase. The average purchases are summed and added to any pre-existing balance, and then the average daily amount of payments on the account is subtracted. The leftover figure is the average balance, which is multiplied by the annual interest percentage rate .

No comments:

Post a Comment